Tulsa, Ok Bankruptcy Attorney: How To Deal With Medical Debt In Bankruptcy

Tulsa, Ok Bankruptcy Attorney: How To Deal With Medical Debt In Bankruptcy

Blog Article

Tulsa Bankruptcy Lawyer: The Role Of Government Agencies In Bankruptcy Cases

Table of ContentsThe Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy AttorneysTulsa Bankruptcy Lawyer: How They Can Assist You Through Financial StrugglesTulsa Bankruptcy Lawyer: Navigating Bankruptcy With A Co-signerBankruptcy Lawyer Tulsa: How To Handle Wage Garnishments And Bank Levies

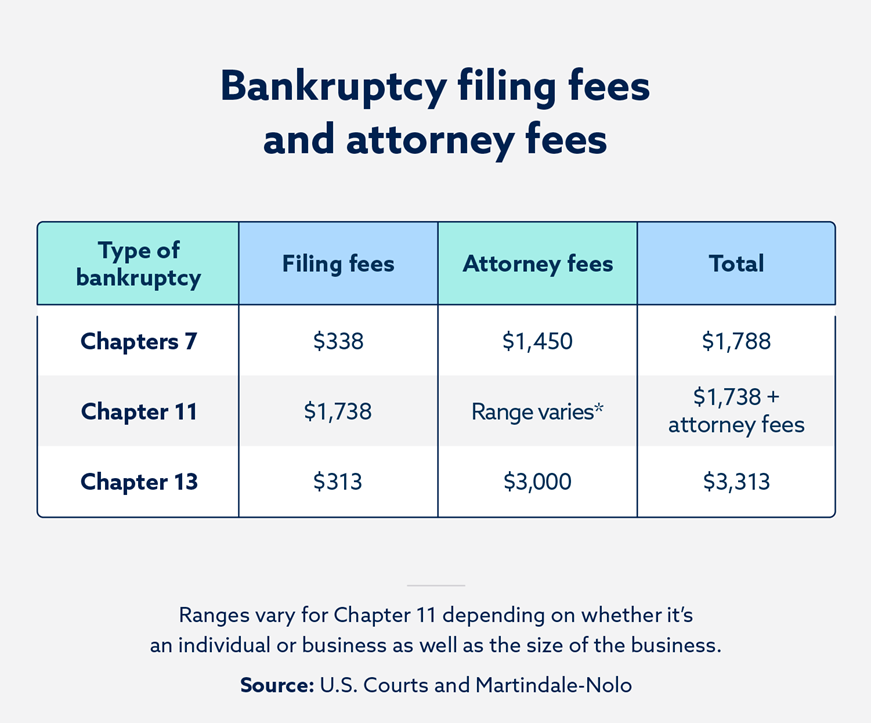

It can damage your credit report for anywhere from 7-10 years and also be a challenge towards getting security clearances. If you can't fix your issues in much less than 5 years, bankruptcy is a viable choice. Legal representative costs for bankruptcy vary depending on which form you select, just how complex your situation is as well as where you are geographically. Tulsa bankruptcy lawyer.Other bankruptcy expenses include a filing fee ($338 for Chapter 7; $313 for Chapter 13); and also fees for credit score therapy as well as financial monitoring courses, which both price from $10 to $100.

You don't constantly require a lawyer when filing private bankruptcy on your own or "pro se," the term for representing on your own. If the case is simple enough, you can declare bankruptcy without help. But lots of people take advantage of representation. This short article describes: when Phase 7 is too made complex to manage on your own why hiring a Chapter 13 attorney is constantly essential, and if you represent yourself, just how a bankruptcy application preparer can assist.

, the order erasing financial obligation. Strategy on filling up out substantial documents, collecting financial documents, investigating personal bankruptcy and also exception regulations, as well as following regional guidelines and procedures.

Tulsa, Ok Bankruptcy Attorney: Debunking Common Bankruptcy Misconceptions

Below are 2 circumstances that constantly call for depiction., you'll likely want a lawyer.

If you make a blunder, the insolvency court could throw out your instance or sell properties you thought you might maintain. If you lose, you'll be stuck paying the debt after bankruptcy.

If you make a blunder, the insolvency court could throw out your instance or sell properties you thought you might maintain. If you lose, you'll be stuck paying the debt after bankruptcy. You may desire to submit Chapter 13 to capture up on home loan arrears so you can maintain your house. Or you could intend to do away with your 2nd mortgage, "cram down" or decrease an auto loan, or repay a debt that won't vanish in personal bankruptcy over time, such as back tax obligations or support debts.

You may desire to submit Chapter 13 to capture up on home loan arrears so you can maintain your house. Or you could intend to do away with your 2nd mortgage, "cram down" or decrease an auto loan, or repay a debt that won't vanish in personal bankruptcy over time, such as back tax obligations or support debts.In many situations, a personal bankruptcy attorney can promptly determine issues you could not identify. Some individuals file for bankruptcy since they do not recognize their options.

The Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy Attorneys

For most customers, the rational selections are Phase 7 and also Phase 13 bankruptcy. Each type has particular benefits that fix certain troubles. For instance, if you want to conserve your residence from repossession, Chapter 13 may be your finest wager. Chapter 7 can be the way to go if you have reduced income and no assets.

Below are typical issues bankruptcy legal representatives can avoid. Personal bankruptcy is Tulsa bankruptcy attorney form-driven. Many self-represented bankruptcy debtors do not file all of the required insolvency documents, and their instance gets dismissed.

If you stand to shed useful residential or commercial property like your residence, car, or other property you care around, a lawyer might be well worth the cash.

A lot of Phase 7 cases relocate along visit homepage naturally. You file for personal bankruptcy, go to the 341 conference of financial institutions, as well as get your discharge. However, not all insolvency situations continue smoothly, and also various other, much more difficult concerns can occur. Numerous self-represented filers: don't recognize the relevance of activities as well as foe activities can't adequately safeguard against an action seeking to deny discharge, and have a challenging time complying with complicated personal bankruptcy procedures.

The Impact Of Bankruptcy On Your Credit: Insights From Tulsa, Ok Bankruptcy Attorneys

Or another thing might turn up. The lower line is that an attorney is vital when you discover on your own on the receiving end of a movement or suit. If you choose to apply for personal bankruptcy by yourself, figure out what solutions are readily available in your district for pro se filers.

, from brochures defining affordable or free solutions to thorough information about insolvency. Look for an insolvency book that highlights scenarios needing an attorney.

You must properly fill in lots of forms, study the regulation, and also participate in hearings. If you comprehend bankruptcy legislation however would certainly like help completing the types (the average bankruptcy request is around 50 pages long), you might think about hiring an insolvency request preparer. A bankruptcy application preparer is anybody or business, various other than a legal representative or someone that functions for a legal representative, that bills a fee to prepare personal bankruptcy files.

Because bankruptcy petition preparers are not lawyers, they can't offer lawful recommendations or represent you in bankruptcy court. Particularly, they can not: inform you which kind of bankruptcy to file tell you not to note certain financial obligations inform you not to detail particular properties, or inform you what home to excluded.

Because bankruptcy petition preparers are not lawyers, they can't offer lawful recommendations or represent you in bankruptcy court. Particularly, they can not: inform you which kind of bankruptcy to file tell you not to note certain financial obligations inform you not to detail particular properties, or inform you what home to excluded.Report this page